Current position:Home > News

2019-10-10

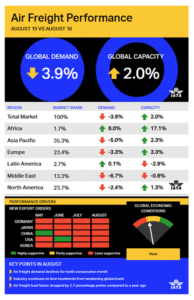

The air cargo industry is now experiencing its longest demand slump since the 2008 global financial crisis. According to the latest IATA air freight report, worldwide demand measured in freight tonne kilometers (FTK) dropped by 3.9% year-on-year in August.

The IATA Director General described the figures as “deeply concerning,” emphasizing that the US-China trade war had the clearest impact yet on international air freight volumes.

For the first time since the financial crisis, air cargo demand has fallen for ten consecutive months. This sustained contraction underscores the fragile state of global trade and manufacturing activity.

Trade conflicts have reshaped supply chains and discouraged cross-border investments. As a result, many logistics providers face weaker order volumes, particularly across Asia-Pacific and North American air routes. The IATA warned that “with no signs of a détente on trade, the tough business environment will persist.”

The association reminded policymakers that trade generates prosperity, while trade wars restrict it—a sentiment shared by many industry leaders who depend on stable freight flows.

Compounding the drop in demand, air cargo capacity in available FTKs increased by 2% compared to last year. Consequently, load factors slipped by 2.7 percentage points to 44.6%, signaling an oversupply of cargo space.

This imbalance between capacity and demand has reduced yield rates for airlines and freight forwarders. Despite rising operational costs, competition remains intense in an industry already burdened by declining global exports.

IATA’s analysis of key economic indicators confirms that the air freight market will likely remain under strain. Global trade volumes are now 1% lower than a year ago, and trade in emerging markets continues to underperform relative to advanced economies.

This disparity results from higher sensitivity to trade tensions, political instability, and currency depreciation across several emerging economies. The global Purchasing Managers Index (PMI) also remains in contraction territory, reflecting falling export orders since September 2018.

For the second consecutive month, all major trading nations reported declining manufacturing export activity, highlighting the persistent weakness in industrial demand for air transport services.

The Asia-Pacific region, home to over 35% of global FTKs, continues to be the hardest hit. Airfreight demand there fell by 5% year-on-year in August, driven by slower Chinese economic growth and the temporary shutdown of Hong Kong International Airport, the world’s largest cargo hub.

In North America, airlines saw a 2.4% drop in demand due to weaker business confidence and the continuing US-China trade dispute. On Asia–North America routes, seasonally adjusted volumes are down nearly 5% compared to the previous year.

Meanwhile, European carriers posted a 3.3% decline, affected by Germany’s weakened manufacturing sector, regional economic softness, and Brexit-related uncertainty.

The Middle East recorded the sharpest contraction at 6.7%, as escalating trade tensions, airline restructuring, and global trade slowdown continued to dampen performance.

In contrast, Latin American carriers barely escaped decline, reporting a modest 0.1% increase in freight demand. However, this growth was weaker than in previous months, reflecting low economic expansion and political instability in the region. Currency volatility further complicated operations in major Latin markets.

African carriers, on the other hand, achieved an 8% increase in FTKs, though this was offset by a 17.1% rise in capacity, limiting overall efficiency gains.

The global air cargo market is facing a prolonged adjustment phase. Although certain regions may benefit from intra-regional trade diversification, overall performance will remain heavily dependent on the resolution of trade disputes and the stabilization of global manufacturing output.

Airlines are expected to tighten capacity management and focus on high-value segments such as pharmaceuticals, e-commerce logistics, and time-sensitive goods. Integrating digital tracking systems and data-driven freight optimization may also help carriers mitigate volatility.

However, until global trade volumes recover, both carriers and freight forwarders must prepare for sustained pressure on margins and yields. IATA’s conclusion remains clear: “Trade generates prosperity. Trade wars don’t.”

As governments reassess tariff policies and corporations adapt to shifting supply chains, the air freight industry’s resilience will be defined by its ability to adapt operations, optimize routes, and maintain service reliability in an uncertain global landscape.

Resource:https://www.aircargonews.net/airlines/air-cargo-in-longest-slump-since-global-financial-crisis/